The VA, AFCPE®, NFCC and VBBP Participant Bank, Bank of Hawaii provided insights into the Veterans Benefits Banking Program more than 3.5 years after inception.

The Veterans Benefits Banking Program launched in December 2019 as a campaign to encourage and provide options for Veterans and other VA beneficiaries to directly deposit their monetary benefits into bank and credit union accounts. Now consisting of 80 participating military-and-veteran-friendly banks and credit unions, the VBBP is going strong and has helped bank over 270,000 Veterans in its 3.5 years.

This year, at the annual 2023 AMBA Fall Workshop, the VBBP Update Panelists offered insights on the entire program, including the participation of banks and credit unions, financial and credit counseling, and an upcoming refresh of the program’s financial education offerings.

Christine Bensedira, director of the Veteran Benefits Administration (VBA) Finance Office, gave an update which included the program’s beginnings, growth, and accomplishments. She described the significance of VBBP’s continuation through a presidential administration transition and that the program has grown from an initial 4 banks to its current 80 (and growing) participating banks and credit unions. Christine also encouraged bankers in the audience whose bank was not a participant to join the VBBP.

Christine also provided an overview of the myriad ways the VA has institutionalized the VBBP. The program has been included in the Transition Assistance Program Guide for transitioning Veterans, the VA has sent over 1.8M notices in check inserts to beneficiaries receiving paper checks, mailed more than 600,000 letters to under/unbanked beneficiaries, sent 78,000 emails, and mailed 2.3M letters to all Veterans announcing the addition of the free financial and credit counseling services. The VA consistently partners and collaborates with State and County Veteran Commissions, participates in coalitions across federal agencies, and participates, alongside AMBA, in the annual National VSO conventions hosted by the VFW and American Legion.

If you didn’t attend our Workshop in person, you missed Christine’s passion for the VBBP. She and her team members, Mike Ewald and Patrick Phillips, are dedicated to banking Veterans, VA beneficiaries, and Caregivers and to providing them the best resources, tools, information, and financial education available to help enhance their financial lives.

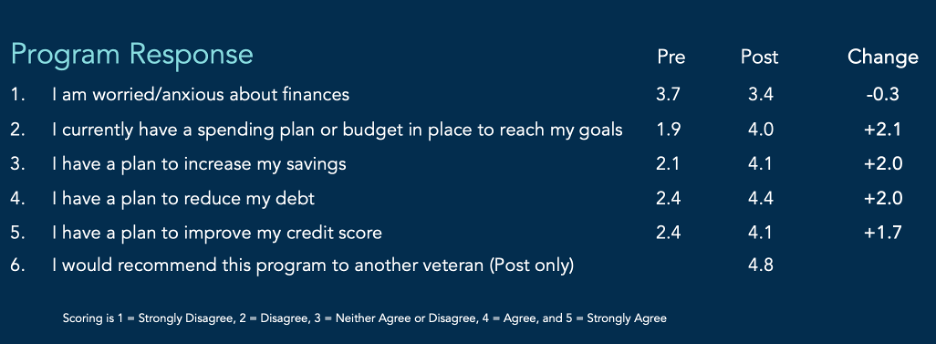

Jenn Pizi and Rachael Deleon provided a coordinated update from their respective organizations, the National Foundation for Credit Counseling (NFCC) and the Association for Financial Counseling and Planning Education® (AFCPE) on VBBP financial and credit counseling sessions. Rachael and Jenn shared demographics on the counseling services. They noted that of Veterans who took advantage of the program, 34% were female, 64% were male, and they represented 50 states and territories. The branches of Service represented were 46% Army, 23% Navy, 15 Air Force, 12% Marine Corps, and 2% Coast Guard. The top reasons for seeking counseling were budget counseling, improving credit scores, and debt reduction. As of June 2023, almost 800 financial and credit counseling sessions have been completed. The program’s impact is evident in the pre and post survey data highlighted in the chart below:

In addition to the survey responses, they also shared some anecdotal feedback from NFCC and AFCPE® counselors:

“I was overwhelmed and scared, with over $60k worth of debt, yet by remaining optimistic, I was able to pay off everything and ultimately respect myself.”

“…it saved me, it helped create a healthier financial future which helped me mentally and emotionally become [a] more stable, well-rounded person, a more stable life.”

“[This program] was exactly what I needed in my life…My wife and I had questions that we were reluctant to ask for fear of being embarrassed about having so much work to do at our age, and [my counselor] came through with answers and resources for our unasked questions.”

“I love living a life where I am not constantly stressing and worrying about my finances. I have learned how to save and financially plan for the future while not spending money that I do not have or can pay back immediately. Best of all I am passing on these skills to my 3 children.”

Fred Alvarado from Bank of Hawaii joined the panel as a VBBP bank representative. Fred illustrated his bank’s impact through the VBBP by describing how he helped bank a homeless Veteran and a Veteran who didn’t trust financial institutions. When Bank of Hawaii joined the VBBP, Fred’s asked to have his name, email, and phone number placed on the VBBP website as his bank’s point of contact. This not only enabled personal connections with struggling Veterans but also initiated and solidified relationships with other Oahu organizations supporting the military and veteran communities.

Steve Lepper, AMBA’s president and CEO, concluded the panel by describing the future of VBBP. “VBBP 2.5” will feature a new LifeCents-designed website with searchable database of VBBP banks and credit unions, as well as a dynamic and interactive pathway approach to financial education. This update is scheduled to roll out in early November 2023. AMBA and its partners will share more information as our plans evolve.

The VBBP Panel was the only panel during the Workshop that exceeded its allotted time. This is not a criticism; it was difficult to contain each panelist’s passion. VBBP has been very successful and is changing lives. We all just want to continue to do more and support those Veterans who have provided us with so much. We’re just getting started!