By Amy Miller, AFC®

August is home to National Financial Awareness Day (August 14, 2023) and is a time to review finances, make plans, and take steps toward a healthy financial future.

According to FINRA’s 2021 National Financial Capability Survey, 56% of respondents reported feeling anxious about their finances daily, 42% think about their finances daily and 58% reported financial anxiety. One of the first steps to relieving financial stress is knowing exactly where you stand. We’re going to focus on ways to be more financially aware throughout the month.

This blog will focus on understanding military pay. Unfortunately, military pay can be very confusing. Understanding when you’ll be paid, how you’ll be paid, what you’ll be paid, and what you’ll be taxed are factors that are important to know and track when building a financially healthy foundation.

Types of Military Pay

There are three main types of military pay: Basic Pay, Special and Incentive Pay, and Allowances.

Basic Pay is paid to all service members and is the largest portion of all pay received. It is based on pay grade and years of service and is taxed as ordinary income.

Special & Incentive Pay (S&I) are additions to pay that are meant to supplement a member’s income for specific or special qualifications. There are over 60 qualifying circumstances including hardship or hazardous duties as well as special assignments and serving in combat zones. Special and incentive pay may be subject to federal and state taxes.

Allowances are also in addition to basic pay and are meant to offset the cost of specific needs like food and housing. Most allowances, including the Basic Allowance for Subsistence (BAS) and Basic Allowance for Housing (BAH), are not subject to taxes. However, some others, including CONUS COLA (Cost of Living Allowance), are taxable.

In addition to these three main pay categories, service members can also receive a one-time, midcareer bonus called Continuation Pay if also enrolled in the Blended Retirement System (BRS). When continuation pay will be received and the amount paid depend on several factors and vary by branch. Continuation pay is subject to both federal and state taxes and must be repaid if the service member’s commitment is not fulfilled.

Military Pay tables can be found here.

Leave and Earnings Statement (LES)

Leave and Earnings Statements, also known as an LES, is the best place to start when trying to understand and track the different types of military pay and taxes. It’s the military version of a paystub and outlines pay, taxes, and deductions as well as leave balances and TSP contributions.

Active duty, Guard, Reserve and retiree LESs can be found by logging into myPay, the online system operated by DFAS. Coast Guard members use a different site known as the Pay and Personnel Center.

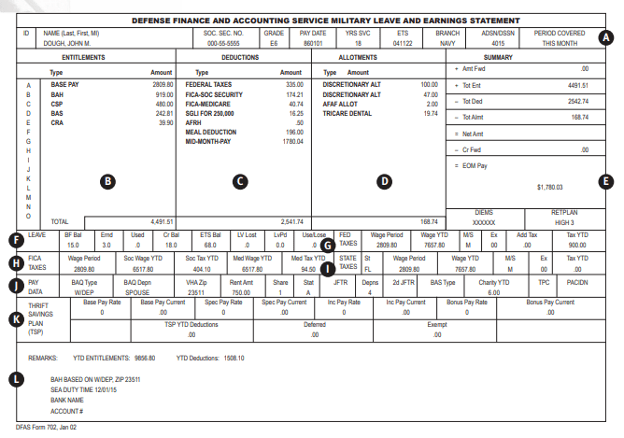

Here is an example of an LES and an outline of the information each section includes:

A – Name, Social Security Number, years of service, branch and pay period

B – Wages, bonuses, incentive pay, and allowances including BAS & BAH earned during the pay period. The upper section will display up to 15 entries, additional entries will be shown in a lower section under remarks.

C – Deductions, including federal and state tax withholdings, FICA, and SGLI (Servicemember’s Group Life Insurance) premiums.

D – Allotments are deductions from pay that can be set up by the service member. In addition to direct deposits to checking and savings accounts, members can use allotments to pay for things like life or dental insurance directly from their pay. They can also be used to buy U.S. savings bonds or contribute to an Individual Retirement Account (IRA). They are not allowed to be used to pay for personal loans like automobiles, appliances, or jewelry. Half of the allotment amount is deducted from the mid-month pay and the other half at the end of the month pay and is then transferred to the appropriate account(s).

E – Summarizes all entitlements, allowances, deductions, and allotments and outlines the unpaid amounts for each category.

F – Outlines leave earned, used, projected, the balance as of the end of the pay period along with the number of days of leave that can be lost if not taken in the current year.

G – Federal Taxes

H – FICA Taxes

I – State Taxes

J – Pay Data includes additional information on housing allowances, COLA, etc.

K – Thrift Savings Plan (TSP) contributions

L – The Remarks section provides general information and explanations of any changes in pay. It also lists any entries from the above categories that exceed the 15-entry limit.

Military Paydays

Military pay is typically paid twice per month, with the LES usually available a week prior. A complete list of these dates can be found here.

For help with military pay and compensation, contact an installation finance office or DFAS Customer Service at 1-888-332-7411 or visit their website.