By Amy Miller, AFC®

National Homeownership Month is designated as a time to recognize the value of homeownership for American families. Homeownership is considered part of the American Dream and a way to build financial stability and wealth. For the month of June, we’ll be covering topics related to housing and homeownership.

Monthly mortgage payments are made up of more than just principal and interest. Knowing what is included is another key step in the home-buying process. This week, we’ll discuss the 4 parts of a mortgage payment, known as PITI – Principal, Interest, Taxes & Insurance:

- Principal

This is the portion of the mortgage payment that is paid toward the original balance of the loan. Typically, the principal balance portion of the payment starts low and slowly increases over time, resulting in a larger amount of the payment being applied in the final years of the loan.

Most mortgage lenders will provide a mortgage amortization schedule or amortization table, that outlines the exact amount from each payment that will be applied to the principal and interest. Many online calculators can be used to create one if a lender doesn’t provide it.

- Interest

Interest is the fee paid to the lender for loaning the money to purchase the home. The interest charged on a mortgage is a percentage of the principal balance and directly impacts monthly payments. Initially, a large portion of the monthly payment is interest. As the loan matures, less will be allocated to interest and more to the principal.

Fixed-rate mortgage monthly payments remain constant throughout the life of the loan. Adjustable-rate mortgage monthly payments, however, vary as interest rates change. Monthly payments increase as mortgage interest rates increase.

- Taxes

Property taxes or Real Estate taxes are charged by local government agencies and are used to fund public services like schools, firefighters, road maintenance, parks, and police.

Taxes are typically charged annually and spread across 12 monthly mortgage payments. The tax portion of each payment is then held in an escrow account until the taxes are due, at which time the lender will pay them directly.

Because taxes change yearly, mortgage payments are also adjusted yearly.

- Insurance

Property insurance protects homeowners against loss due to a fire or theft and, unless waived, is required by most lenders and premiums are included in monthly mortgage payments. Like taxes, this portion of the monthly payment is held in an escrow account until the premium is due and paid by the lender. Also like taxes, changes in premiums can change monthly payments.

Unless a homebuyer pays a down payment of 20% or more, Private Mortgage Insurance (PMI) will generally be required on all conventional loans. PMI protects the lender if the borrower is unable to repay the loan.

Department of Veterans Affairs (VA) Home Loans help eligible active-duty service members and Veterans purchase homes with little down payment and, unlike conventional loans, do not require PMI. However, VA loans have funding fees. Learn more about VA loans and 2023 Funding Fees here.

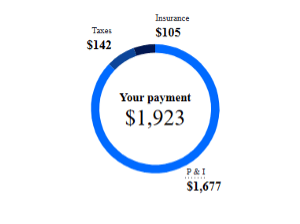

In summary, here’s an example of an estimated mortgage payment PITI breakdown. This is based on a home purchase of $250,000 using a VA loan with a $0 down payment and is calculated using the current national average interest rate of 7.08%.

This is an example; please consult a lender for a specific estimate based upon your individual loan amount, down payment, terms, and interest rate.

If you’re ready to take the next step in the home-buying process, check out our tips on choosing a lender. We also encourage you to search our membership directory where you can find a list of the many AMBA member banks offering mortgages.