By Amanda Mitchell, AFC® Candidate

The phrase “keeping up with the Joneses” is a familiar idiom that refers to the need we feel to compare the things we have with what others have. This money mindset can be particularly costly for two reasons:

- What the “Joneses” have is constantly changing.

- It is driven by our emotions.

This can be a tough money mindset to overcome because it requires us to confront emotions. Here’s where to start:

Understand Why We Feel We Need Things

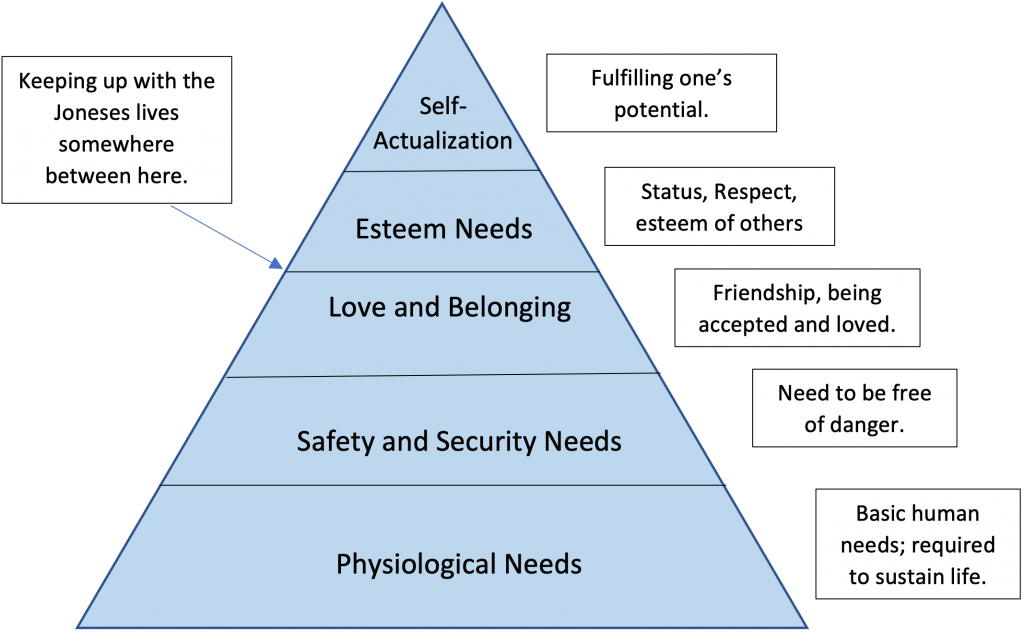

Many different theories of psychology try to explain why we do the things that we do. One theory that I feel really encompasses financial psychology is Maslow’s Hierarchy of Needs. Maslow’s theory focuses on humans being “creatures of need. Once a “lower-level” need is satisfied, another set of needs appears. This theory is particularly useful when thinking about why we spend money on the things we do because it points out that there is an emotional component. It can help us pinpoint what psychological need we are trying to satisfy to make better decisions. If you are constantly a victim to “keeping up with the Joneses,” you may want to take a deeper look at why. Could it be that you crave belonging? Could it be that you want the respect of others? Is it a status thing? All of these are normal feelings. Being able to understand what drives you can help you avoid pitfalls.

Ways to Overcome This Mindset

- Practice Gratitude. Start a gratitude journal. Each day write one thing you are grateful for. Make it a habit of appreciating what you have now. The longing for more will begin to fade.

- Set financial goals. Give yourself something to be proud of. Accomplishing our goals financial goals, no matter how small, feels good. It can help to give you something to be proud of and foster a feeling that we are doing what is best for us right now.

- Do your best not to compare. Comparison is the thief of joy. Your journey is unique. You face different challenges than others. Focus on where you are and how far you have come. Focus on you.

- Consult with a professional. Overcoming a money mindset that has deep emotional ties can be particularly difficult. Just know that you are not alone. Everyone has emotional connections with their money. It’s normal. What is most important is your commitment to moving forward and getting the resources you need to help you. Discuss your situation with a financial counselor or behavior health professional. They can help you see where your emotions come into play and how to overcome them to help you make better financial decisions or refer you to the resources you need. You can contact your installation’s community service office to speak with a financial counselor or make an appointment with your local behavioral health office.